Target deals with an increasingly price sensitive shopper: 'We see our guests holding out for and expecting promotions more than ever,' says EVP

Target is seeing consumers pull back on discretionary purchases such as a new TV or couch, and instead refocusing their spending on food & beverage purchases.

The general merchandise retailer reported a 2.7% year-over-year sales increase in Q3 2022 led by strong double-digit growth in its Food & Beverage business on top of a 50+% sales increase last quarter and a 1.4% increase in store traffic vs. the same quarter last year.

"Food & Beverage continues to outperform the market with low double-digit growth and strength across the portfolio, gaining both dollar and unit share every week throughout the quarter," said Target EVP & chief growth officer Christina Hennington on the company's Q3 2022 earnings call.

"With inflationary food prices absorbing more of their spending, those costs are crowding out other categories, including spending on discretionary items, and in some cases, even household essentials."

By comparison, sales in home, apparel, sporting goods, and electronics categories were all down between low- to mid-single digits for the quarter compared to the same period last year.

"We see our guests holding out for and expecting promotions more than ever, spending less on regularly priced items," noted Hennington.

Increased price sensitivity impacts bottom line

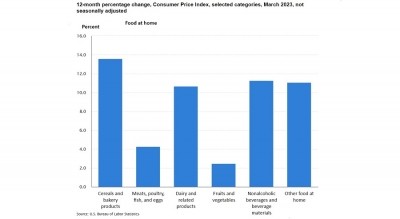

While inflation and the average price of goods eased in October (according to the latest Consumer Price Index figures), consumers still feel financial pressure to limit household spending in most areas and are exhibiting increased price sensitivity.

"We’ve had a consumer who has been dealing with very stubborn inflation for quarter after quarter now. They’re shopping very carefully on a budget," said Target CEO and chairman Brian Cornell on the call.

"With high rates of inflation contouring the road, and their purchasing power, many consumers this year have relied on borrowing or dipping into their savings to manage their weekly budgets. But for many consumers, those options are starting to run out. As a result, our guests are exhibiting increasing price sensitivity, becoming more focused on and responsive to promotions and more hesitant to purchase at full price."

While the retailer is focused on providing more promotions and deals to its financially stressed consumer base, rampant trade-down behavior is having an adverse effect on the business, said Cornell.

"Q3 profitability came in well below our expectations, driven by several factors. First and foremost, we faced an unexpected gross margin rate headwind from a higher-than-expected mix of promotional sales as guests moved away from full-price purchases," he noted.

"In addition, like the rest of the industry, we’re facing a growing financial headwind from [inventory shrinkage], which is running hundreds of millions of dollars higher than a year ago. Along with other retailers, we’ve seen a significant increase in theft and organized retail crime across our business. As a result, we’re making significant investments in training and technology that can deter that and keep our guests and store team members safe."

Streamlining business: 'This effort is not about slashing resources'

Last quarter, Target shared that it was cutting its inventory levels by 20% to streamline its business and bring about long-term growth. Looking ahead, the company is making additional efforts to optimize and streamline its business.

"To create additional capacity for us to continue investing in long-term growth and market share while also delivering strong bottom line performance, we are undertaking an enterprise-wide effort to identify opportunities to simplify and enhance the efficiencies of our business," said Cornell.

"I want to make it clear. This effort is not about slashing resources, instead, it’s about optimizing our operations to match the scale of our business. This effort is particularly important today because of the rapid and unanticipated level of scale our business is added since 2019 as total revenues have grown from less than $80bn in 2019 to a projection of well over $100bn this year."

The opportunity to further streamline its business could create $2-$3bn in savings over the next three years for the business, according to Cornell.

"While our team has done an excellent job of staying agile and quickly accommodating all that growth, we now have an opportunity to look from top to bottom across all of our operations to ensure they are fully optimized for the size of our business," he added.