“The commercial availability of PrimaColl [produced in partnership with Arxada, formerly Lonza] signals that it’s no longer a pipe dream, but a reality, that consumers can expect to see bio-designed ingredients on shelves in their favorite products,” said Geltor CEO and co-founder, Alex Lorestani.

“This is a really big deal,” he told FoodNavigator-USA. “We started selling in the market in 2019, when we did around 10,000 liters of fermentation. In 2020, we started serving more customers and did about 100,000 liters, and then last year, we did millions of liters.

“We still have a long way to go, as the collagen market is hundreds of kilotons of product. But we’ve demonstrated we can run a process at full scale. Now, we’ve got to scale this out to multiple facilities, so we can serve customers and hit the volumes they're really looking for."

He added: “The growth in the collagen market has completely blown me away; we’ve got big CPG companies coming to us and saying, Hey, we need to get animal collagen out of our products and we have launches on dates X, Y, and Z. Can you help us?”

Type 21 collagen ‘too scarce to obtain from the traditional process of isolating collagen from animal skin and bones’

Distinct from plant-based collagen ‘builder’ or ‘booster’ formulations, PrimaColl is a nature-identical match to the bioactive amino acid core of Type 21 poultry collagen, says Geltor, which deploys synthetic biology to engineer microbes such as E. Coli to produce collagen (which is traditionally extracted from animal skin, bones, and connective tissue) via a fermentation process.

"This functional core contains a high concentration of glycine and proline, amino acids known to enable essential cell signaling, which helps activate additional collagen production in the body."

Type 21 collagen – which like all collagens, decreases as we age - is extremely rare in nature, and is not commercially available from animal-based sources, said Lorestani, who said a third-party clinical trial of PrimaColl is in progress.

“It’s too scarce to obtain from the traditional process of isolating collagen from skin and bones.

“But we’ve been able to ask, if you’re not beholden to what you can get from animal skin and bones, which collagen would you pick? And that's how we got very focused on type 21 collagen. We learned a lot about it when we brought HumaColl21 to the beauty and personal care market and have been able to extend that that set of learnings to the food and nutrition market.

“This is an ingredient that would be impossible to source in any other way other than through bio-design.”

‘This opens up all kinds of new formulation possibilities’

A high-purity concentrated product, PrimaColl also has formulation advantages over animal-derived collagens as it “delivers greater potency and does not include secondary components common to animal-derived collagens which can impact solubility and present formulation challenges,” claimed Lorestani.

At the most basic level, he said, “One of the things that becomes obvious to people right away, some animal collagen smells like an animal, and when you open up your beverage or coffee and all of a sudden you get hit with something that smells like you know, stale pig, that's not great.

“We can do something so much better, and this opens up all kinds of new formulation possibilities.”

What do you call vegan collagen?

So what kind of customers are interested in vegan, or ‘animal-free’ collagen, and why?

Customers Geltor is engaging with have been eager to offer a real vegan collagen for a long time, claimed Lorestani, who launched his first animal-free collagen products in the topical skincare category and is now targeting food and dietary supplements.

Asked about labeling in the US market, he said: “While the ingredient declaration is currently in progress and not finalized, we expect it to be collagen with a descriptor, eg. ‘microflora-derived collagen.’”

The market opportunity

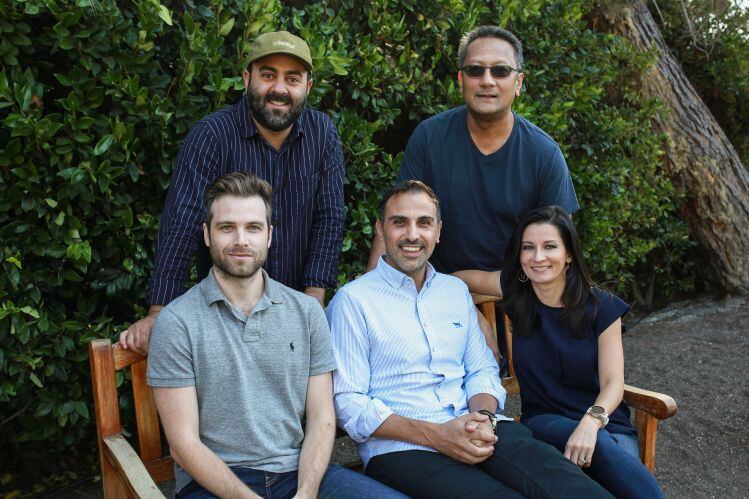

Speaking to FoodNavigator-USA last year, VP business development Scott Fabro said: “Collagen is one of the fastest growing ingredients in the functional food and beverage space.”

While the functional benefits will be key to the ingredient’s ‘beauty-from-within’ appeal, its ‘animal-free’ credentials are also attractive to food and nutrition brands, many of whom are looking to make vegan claims for environmental, ethical, or religious reasons (pork-derived collagen is not halal or kosher, while bovine collagen is only halal if the animals were slaughtered in a certain way), said Fabro.

“We are already engaged with several dozen customers, and the interest level is extremely high," added Fabro.

"Vegan collagen is for everyone. There’s no dietary restriction, no religious restrictions, and it’s an opportunity for customers to differentiate themselves in the market; we’ve had interest from companies interested in adding it to everything from beverages to baked goods to gummies.”

The GMO factor

Asked whether the ‘GMO factor’ puts any potential customers off (Geltor uses synthetic biology to genetically engineer bacteria to produce target proteins, although its final products are not GMOs), he noted that there are compelling ethical and environmental arguments for making animal proteins without raising or slaughtering animals.

Attitudes towards the technology had also changed “quite dramatically” in recent years, claimed Fabro, who dealt with some messaging issues around engineered microbes when he worked at Cargill and Evolva on producing stevia sweeteners via microbial fermentation.

"Customers just continue to be more and more aware of the benefits of fermentation to produce hard to get ingredients."

Traditionally, collagen is sourced from animal skin, bones, and connective tissue, while collagen peptides are produced through the enzymatic hydrolysis of collagen.

Geltor - by contrast - starts with E Coli bacteria and inserts DNA sequences - basically a set of instructions - that effectively 'program' the bacteria to produce collagen proteins.

The company has filed multiple patents covering its use of machine learning and modified bacteria to produce collagen proteins and is continuing to grow its IP portfolio.