Proponents of cell cultivated meat, where stem cells are grown in bioreactors to create animal-identical proteins, believe this technology offers an alternative future for food. One where animal agriculture, which is characterised as highly polluting and resource intensive, is no longer necessary. But as cultivated meat pioneers move beyond proof of concept, they are coming up against a common challenge.

Regulatory and consumer acceptance aside, cultured meat companies need to work out how to bring down the price of production and move to scale.

Beyond the initial capex required, the biggest cost component for cultivated meat makers is the media in which cells are grown. Cell culture medium is a mixture of a carbon-based energy source such as glucose, amino acids, salts, vitamins, water, and other components to support cell viability and vitality. Currently, it is estimated that growth factors and cell-culture media take up anywhere between 55-95% of the marginal cost in manufacturing cell-based foods. Creating the biomass required for cultivated meat to achieve mass-market penetration at a competitive price requires a significant reduction in this expense.

Israeli start-up BioBetter believes it has an answer. According to the company, it can deliver a ‘sustainable, efficient and flexible’ response to the market need for more competitively priced growth factors, specifically insulin, transferrin, and FGF2.

Tapping tobacco for cheaper growth factor

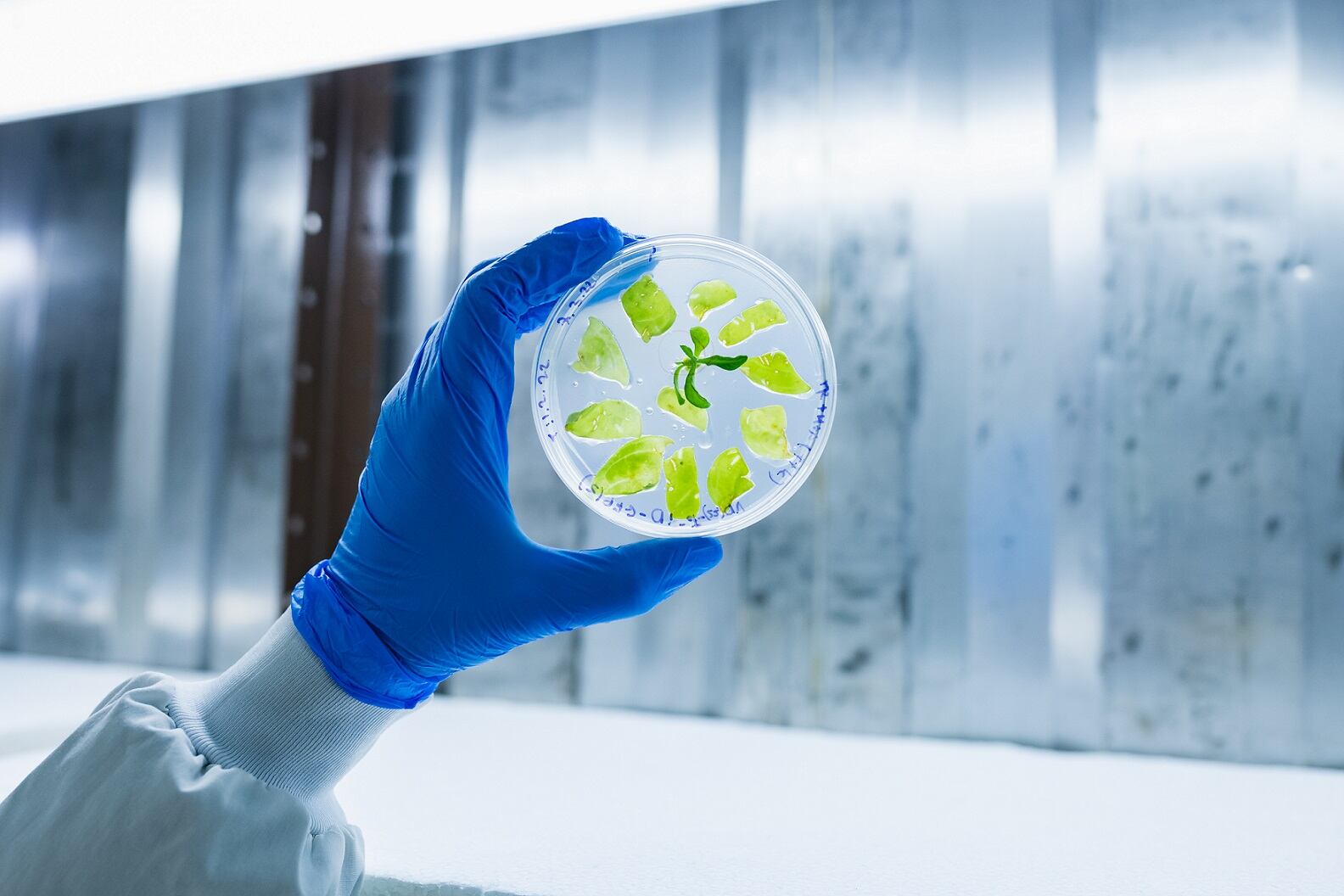

BioBetter harnesses the ‘inherent advantages’ of the tobacco plant Nicotiana tabacum, using tobacco plants as bioreactors to create the growth factors necessary for the cellular development of cultivated meat. Field-grown tobacco plants are used as ‘natural, self-sustaining, animal-free bioreactors’, the company explained. The start-up applies a proprietary protein extraction and purification technology that enables it to exploit nearly the entire plant, and at the same time deliver a high purity product at broad scale production.

According to Amit Yaari, PhD, CEO of BioBetter, the cost savings generated are significant. “According to the information we currently have, the prices of growth factors sold commercially, range from about US$160 per gram of insulin, to $50,000 per gram of FGF2 and can reach up to $1M for proteins such as TGF beta. According to our techno-economic model, the production costs of a gram of protein using Biobetter’s technology are expected to reach $1 per gram,” he told FoodNavigator.

This figure is based on cost calculations assuming large production volumes can be reached. “Biobetter's model is targeting commodity scale and cost, therefore economy of scale plays a major part,” we were told.

Investment for scale

The company has just closed a $10m series A funding round that it says will ‘be instrumental in accelerating cell-cultured meat closer to its ambitions for broad scale production’.

BioBetter revealed it will double its workforce and expand to a larger pilot plant within the Tel Hai Industrial Park in the Upper Galilee Region of Israel. This new site will ‘substantially’ increase its tobacco plant-processing capacity, enabling it to meet its current pool of commissions emanating from cell-based meat cultivators globally. The new funding also will be applied to broaden BioBetter’s product portfolio of growth factors, the group revealed.

“Pilot scale production will certainly make it possible to reduce production costs, but in order to reach Biobetter's price targets, a production volume of hundreds to thousands of kg per year is required. It is important to emphasize that BioBetter can be profitable even in much smaller production volumes if we take into account the prices of proteins available in the market today,” Yaari noted.

The round was led by Jerusalem Venture Partners (JVP), with additional investment from Milk and Honey Ventures , and the Israeli Innovation Authority (IIA).

“BioBetter has the key to scale up production of cultivated meat, make it accessible to consumers globally and protect our planet,” reflected Erel Margalit, Founder & Executive Chairman of JVP & Margalit Startup City. “This is not only because of the sheer volumes of GFs it can produce but also by virtue of its ability to substantially reduce their cost.”

Tobacco’s ‘comeback’?

Nicotiana tabacum has no place in the food or feed chain due to its bitter taste and alkaloid content. As demand for cigarettes has fallen globally, concerns have mounted over the future of tobacco growers.

This points to the positive impact that BioBetter could have beyond the cultivated meat sector, according to Nisan Zeevi, Director of JVP and VP of Margalit Startup City Galil.

“This venture will create a significant new source of income for local farmers. As cellular agricultural expands, we will dedicate some 500 acres here in the galilee of tobacco plantations to support the industry,” he said. “This helps growers find new purpose in the burgeoning alternative protein scene following a reduction in smoking over the last decade that has left many tobacco fields idle and tobacco farmers suffering financial loss.”

“Thanks to the BioBetter platform, tobacco is set to make a pivotal comeback as a catalyst for bringing better food security,” added Dana Yarden, MD, co-founder of BioBetter. “As a result of this funding round, we can scale up production in 2023 and expect to go commercial with our tobacco plant-derived, food-grade GF portfolio by 2024.”