Fresh salmon, however, continued to fight the tide of inflation with higher prices offsetting lower prices for cod and tilapia and slowing overall volume recovery for fresh finfish, according to the sales data for the four weeks ending Sept. 29 that was released last night.

The flipside of the price fluctuations for both shellfish and finfish were corresponding shifts in dollar sales, with lower prices for shellfish dragging down dollar sales and higher prices of salmon helping lift fresh finfish dollar sales, according to the data.

A closer look at shellfish: 'First signs of demand recovery'

In September, fresh shellfish prices dropped 2.7% compared to the same period last year and a whopping 15.7% from September three years ago, which helped prices for the segment for the full year decrease 4.6% over the prior year and 13.6% over three years ago.

Within shellfish, fresh and frozen shrimp showed long-awaited “first signs of demand recovery,” which 210analytics President Anne-Marie Roerink declared “positive news for seafood” overall.

By her analysis, fresh shrimp prices dropped 2.7% in September to an average of $7.94 per pound compared to the same period last year, while frozen shrimp prices fell nearly twice that – dropping 4.7% to $7.36 per pound in September compared to the same month last year.

The price declines helped drive volume gains for fresh shrimp with pounds sold up 3% in the month compared to a year ago and dollar sales up 0.2% in the same period. Frozen shrimp volumes also increased 0.9% in the period, but dollar sales fell 3.8%.

“Shrimp are the frozen seafood powerhouse, with sales of $3.8 billion in the latest 52 weeks,” Roerink said. She explained frozen shrimp’s long-awaited “turnaround in its volume sales after deflationary conditions … is an encouraging sign,” even though the increase in pounds “was not enough to overcome the gap left by deflation.”

She added, “Given the enormous footprint of shrimp in frozen, fingers crossed on the continuation of the recovery.”

Volume sales for fresh shellfish more broadly increased 1.2% in the month thanks in part to lower prices. But the dip in price is a double-edged sword with dollar sales dropping $1.5% in the same period – illustrating the importance of volume increases to make up for price decreases.

Finfish in focus: Fresh salmon prices rise while cod, tilapia fall

The price decline for fresh shellfish helped offset a 0.4% increase in fresh finfish in September compared to a year ago, which was driven by a 2.4% price hike in September for fresh salmon to $11.53 per pound compared to a year ago. By comparison, the price for fresh cod and tilapia fell 3.8% and 3.9%, respectively, in September over a year ago.

The overall uptick in fresh finfish price helped boost year-over-year dollar sales for the segment by 0.4%, but unlike with shellfish volumes of fresh finfish did not suffer — rather it increased 0.8% year-over-year. This could be attributed to the drop in price for cod and tilapia.

Dollar sales and volumes of frozen finfish outperformed their fresh counterparts, according to Circana. Frozen finfish dollar sales increased 2.3% year-on-year and pounds sold increased 2% in the same period.

This was driven in part by frozen salmon, which unlike its fresh counterpart, saw dollar sales increase 1.4% and pounds increase 6.5%, according to Circana. Frozen cod also performed well with a 7% increase in dollar sales and a 8.4% increase in volume over the previous year. Frozen tilapia, however, was an outlier with dollar sales down 2.2% and volume down 6.9%.

Shelf stable seafood continues turnaround

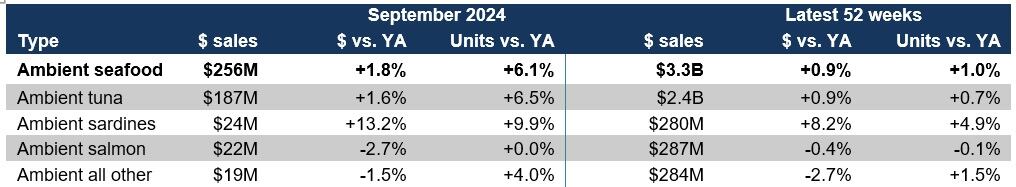

Sales and volume of ambient seafood, including cans and pouches, also improved in September with sales up 1.8% to $256 million and units up 6.1% compared to last year, according to Circana.

“Tuna was, by far, the largest seller and responsible for the category’s growth,” with dollar sales up 1.6% to $187 million, units up 6.5% and pounds up 8.6% year-over-year, Roerink noted.

“Canned seafood is a hurricane stock up item,” and likely benefitted from consumers in the Southeastern state stocking up on grocery basics in the last week of September ahead of hurricane Helene, according to Roerink. She added the “pattern repeated during the week ending Oct. 6 in advance of hurricane Milton.”

“Some consumers also stocked up leading up to the Gulf and Eastern port strike that handle over half of US import and export volumes — causing disrupted grocery buying patterns across the nation in late September,” she added.

Ambient sardines also shot up in September, during which Circana reported a 13.2% increase in dollar sales to $24 million and a 9.9% increase in units over a year ago.

“The increase in canned sardines may be related to the strength of frozen pizza sales as well as make-your-own pizza ingredients in the past year,” Roerink hypothesized.