IRI pacesetters: What were the top 10 food and beverage product launches in 2018?

“Two thirds of total sales [of the top 100 Pacesetters] are coming from brands that sold less than $20m during their first full year on the market,” Joan Driggs, IRI's VP content and thought leadership, told FoodNavigator-USA.

“What we don’t see [anymore] are blockbuster products that are all things to all people. That big mass market of yesterday is gone.”

Larry Levin, EVP consumer & shopper marketing, sales and thought leadership at IRI, added: “It used to take $70m just to make the top 10, but in the last few years around $50m has been the ticket to the top 10.”

Another change has been the number of new brands - as opposed to brand extensions - on the rankings, he said, reflecting both the rise of smaller companies but also a renewed focus on innovation from key players such as General Mills and PepsiCo.

“Back in the day, Pacesetters was largely a game of brand extensions by the big companies, but over time more and more new brands are making the list, such as Oui by Yoplait, or Grown in Idaho."

PepsiCo had seven products generating more than $246m in Pacesetter sales in 2018

Driggs added: "It's also interesting to see very successful launches such as Perfect Size for One [mug cakes] from Duncan Hines. It's a brand that's been around for a long time, and it's reaching a new audience. Whereas products like Mountain Dew Ice and Gatorade Flow are maybe not reaching a new audience."

And while it's easy to lump all large CPG companies together in conversations about 'Big Food' having lost its way, some key players have proved that they can come up with successful new products, she said.

"PepsiCo had seven products generating more than $246m in Pacesetter sales in 2018 and General Mills had seven products generating $177m."

Trial, repeat, and promotional activity

The report looks at year one multi-outlet* dollar sales for brands that completed their first year of sales in 2018. The clock starts ticking when a product hits 30% distribution and lasts 52 weeks, explains IRI, so would cover, for example, sales of a brand that hit 30% ACV in September 2017 and completed its first full year of sales in September 2018 (and explains why some brands that launched some while back – such as RXBAR - make the list).

According to these criteria, Kinder Joy was #1, notching up $124.4m in retail sales in its first full year on shelf, followed by M&M’s Caramel at $120.6m, and Oui by Yoplait at $100.5m.

When it comes to trial and repeat, Kinder Joy (which is a hit overseas but was not available in the US until 2017) was able to achieve positive trial with little dependency on trade promotions, noted IRI, while Gatorade Flow, which has a loyal following of sports drink fans, “had impressive repeat, although its shoppers are also accustomed to Gatorade products being promoted.”

Will you still love me tomorrow?

Asked whether appearing on the Pacesetters report was a good predictor of long-term success, or merely proof that large companies have the money and clout to ramp up distribution and notch up sales of new lines very quickly, Levin told FoodNavigator-USA: "Among the 2017 top 10 pacesetters, seven maintained or increased sales in year two.

"The theme song for year two is 'Will you still love me tomorrow?' so you've got to protect your babies, but I think Kinder Joy is going to keep growing. It's created an incredible base of new consumers. This product alone is responsible for 70% of new growth in the confection space, and [brand owner] Ferrero is not resting on its laurels, so I don't expect them to take their foot off the pedal in year two."

Self-care

While consumers are looking for products with cleaner labels and short ingredients lists, they are also looking for innovative new ways to indulge, he said, noting that IRI consumer research revealed that many consumers say they try to eat healthily 50% of the time and eat whatever they like for the rest of the time.

"It's about self-care. 80% of Americans say they have a regimen around self-care and treats are part of this."

Early adopters of new CPG products tend to be younger consumers (Gen Z and Millennials), who like to share their discoveries and opinions on social media, said IRI’s Larry Levin. They are typically a little bit better educated than the general population and are often pet lovers. They also want to support local businesses, he said.

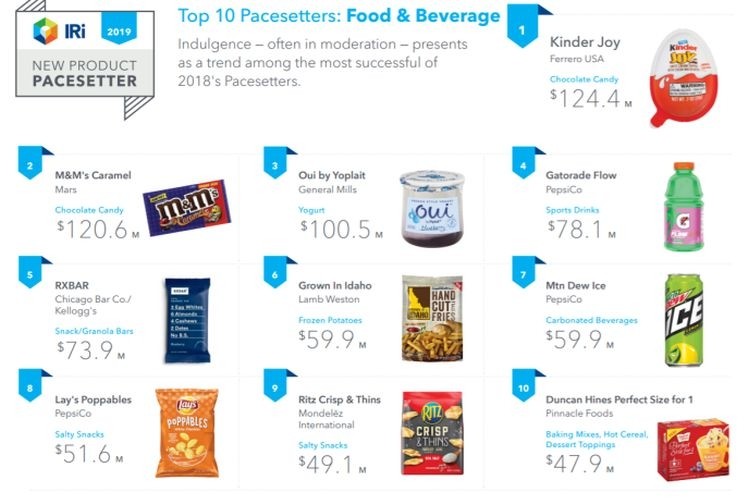

2018 New Product Pacesetters: Top 10 new food and beverage launches (MULO*)

1. Kinder Joy $124.4m

2. M&M’s Caramel $120.6m

3. Oui by Yoplait $100.5m

4. Gatorade Flow $78.1m

5. RXBAR $73.9m

6. Grown in Idaho $59.9m

7. Mountain Dew Ice $59.9m

8. Lay’s Poppables $51.6m

9. Ritz Crisp & Thins $49.1m

10. Duncan Hines Perfect Size for 1 $47.9m

Source: IRI Market Advantage, year-one dollar sales, multi-outlet (MULO)

2018 New Product Pacesetters: Top 10 new food & beverage launches (convenience)

1. Gatorade Flow $144.9m

2. Core Hydration $122.9m

3. Monster Hydro $57.3m

4. Red Bull Purple Edition $52.7m

5. M&M’s Caramel $48.4m

6. Mountain Dew Ice $45.8m

7. Kinder Joy $42.2m

8. Red Bull Lime Edition $37.6m

9. Starbucks Cold Brew $32.1m

10. Pure Leaf Tea House Collection $31.8m

Source: IRI Market Advantage, year-one dollar sales, convenience store channel

Rising stars

Rising stars - which IRI defines as promising new brands that have started their year-one, based on above-referenced 30% ACV, and will complete it in 2019 - include Bubly from PepsiCo, Just Crack an Egg from Kraft Heinz, ONE Bar and Halo Top's new dairy free range.

2018 New Product Pacesetters: Top 10 Rising stars, food and beverage

1. Brownberry sandwich thins

2. Bubly

3. Corona Premier

4. Eight O’Clock K-Cups

5. Enfamil NeuroPro

6. Halo Top dairy free

7. Michelob Ultra Pure Gold

8. Nature’s Own Perfectly Crafted

9. ONE Bar

10. Just Crack an Egg

* IRI multi-outlet (MULO) data covers supermarkets, drugstores, mass market retailers, military commissaries and select club and dollar retail chains but excludes online sales, convenience-stores (which IRI measures separately) and some high profile retailers including Costco and Whole Foods.

According to IRI, three themes dominate this year’s Pacesetters rankings:

Experiential: a memorable and positive experience, delivering indulgence, hitting multiple senses with products that have pleasing or exciting elements.

Expectation: meet consumer expectation for functionality and satisfaction, whether it’s energy, promised results or support of a healthy and active lifestyle.

Simplicity: deliver against consumer demand for easy-to-use natural products, with clean label statements, limited ingredients and a positive impact on the environment.

To download the full report, click HERE.