PepsiCo’s net revenues decline first time since 2020, impacted by pricing and Quaker Oats recall

In the fourth quarter, PepsiCo net revenues dropped 0.5% to $27.85 billion from the same period last year, but grew 5.9% for the full-year ending Dec. 30, 2023. Earnings per share (EPS) in the quarter was 94 cents, and $6.56 for the year.

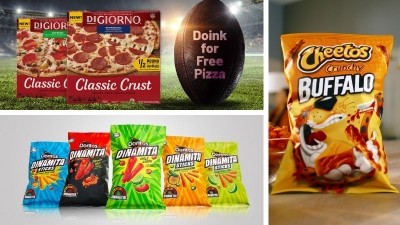

Organic volume also fell across its portfolio, including Frito-Lay North America, Quaker Foods North America, and PepsiCo Beverage North America, which declined 2.5%, 8%, and 7%, respectively. For the full year, the drop in organic volume was less pronounced with Frito-Lay North America falling 1%, Quaker Foods North America down 5%, and PepsiCo Beverage North America down 5%.

For 2024, PepsiCo expects at least a 4% increase in organic revenue, compared to a 9.5% bump projected in 2023. It also expects a core constant currency EPS of atleast 8%.

‘Slowdown in the US’ impacts PepsiCo’s business

While PepsiCo has consistently achieved double-digit or high-single digit growth in net revenue in recent quarters, CEO Ramon Laguarta sees growth returning to pre-pandemic trends as a number of factors impact the business.

"The last few years, we've seen a double-digit growth top line in the business, consistently. ... So, three very good years now. We see in ‘24 ... a normalization of the categories and normalization of the cost [and] inflation, so we see everything trending back to our long-term algorithms."

A food safety recall within the Quaker Oats division also dragged down sales. In the fall, the company recalled Quaker Oats granola bars, cereals, and snacks due to a potential Salmonella outbreak.

The recall “will continue to impact [PepsiCo] ... at least for the first half of the year,” as PepsiCo right-sides this supply chain, Laguarta said.

Price increases that PepsiCo took to sustain growth and address manufacturing cost increases have also started to impact revenues, he admitted.

“We're seeing a bit of a slowdown in the US, both [in] the food category and the beverage category, in the Q4. Part of that is a slowdown due to pricing and disposable income ... part of that is also [a difference] in between in-home consumption and away-from-home consumption that we're seeing in our business in the US. We think that might continue in next year, so that's why we're lowering our guidance.”

However, Laguarta remained optimistic about US consumers and said he hopes larger macroeconomic challenges will lift the business later in the year.

“We feel good about the consumer in ‘24. In the US, we feel good in the sense of very low unemployment. We feel good about the fact that ... wages will go higher than inflation next year. And we hope that by the summer interest rates will go down, and that will create another source of oxygen for disposable income in households, so we feel good about the consumer in the US.”

Where does Rockstar Energy fit into PepsiCo’s growth plans?

When asked about Rockstar Energy being “a relative underperformer” in the market by a Wedbush Securities investor, Laguarta discussed how the brand is leaning on zero-sugar and functional innovation to enhance its market position.

“We're proud of the Rockstar brand. Rockstar has been growing with the category, more or less. There [are] some parts of the country where it's well distributed and well preferred. Other parts of the country, we're trying to get consumer penetration and consumer adoption,” Laguarta said. “The areas where we've been successful with Rockstar, which we will double down [on], are the Zero and the Recover part of the portfolio ... and where we think our R&D can create advantage. So, we're pushing those two platforms.”

Fabiola Torres, GM & CMO, SVP Energy Category at PepsiCo, discussed the brand’s evolution in a recent FoodNavigator-USA interview and how Rockstar has become “the anchor” to the company’s energy-drink portfolio. Last week, Rockstar also released its first functional mushroom beverage, Focus, formulated with lion’s mane and contains 200 mg of caffeine.

The company is also launching the Rockstar brand into international markets, as the company focuses on providing a portfolio of energy drink products that includes Celsius and Starbucks products, Laguarta said.

“We see this as a portfolio of solutions, including Celsius, and how with the combined portfolio, creates a very good point of execution for us. ... It gives us an entry into convenience stores and some other points-of-sale away from home and will continue to drive the portfolio as the unit of execution,” he added.